The EU has a tech problem — and huge potential!

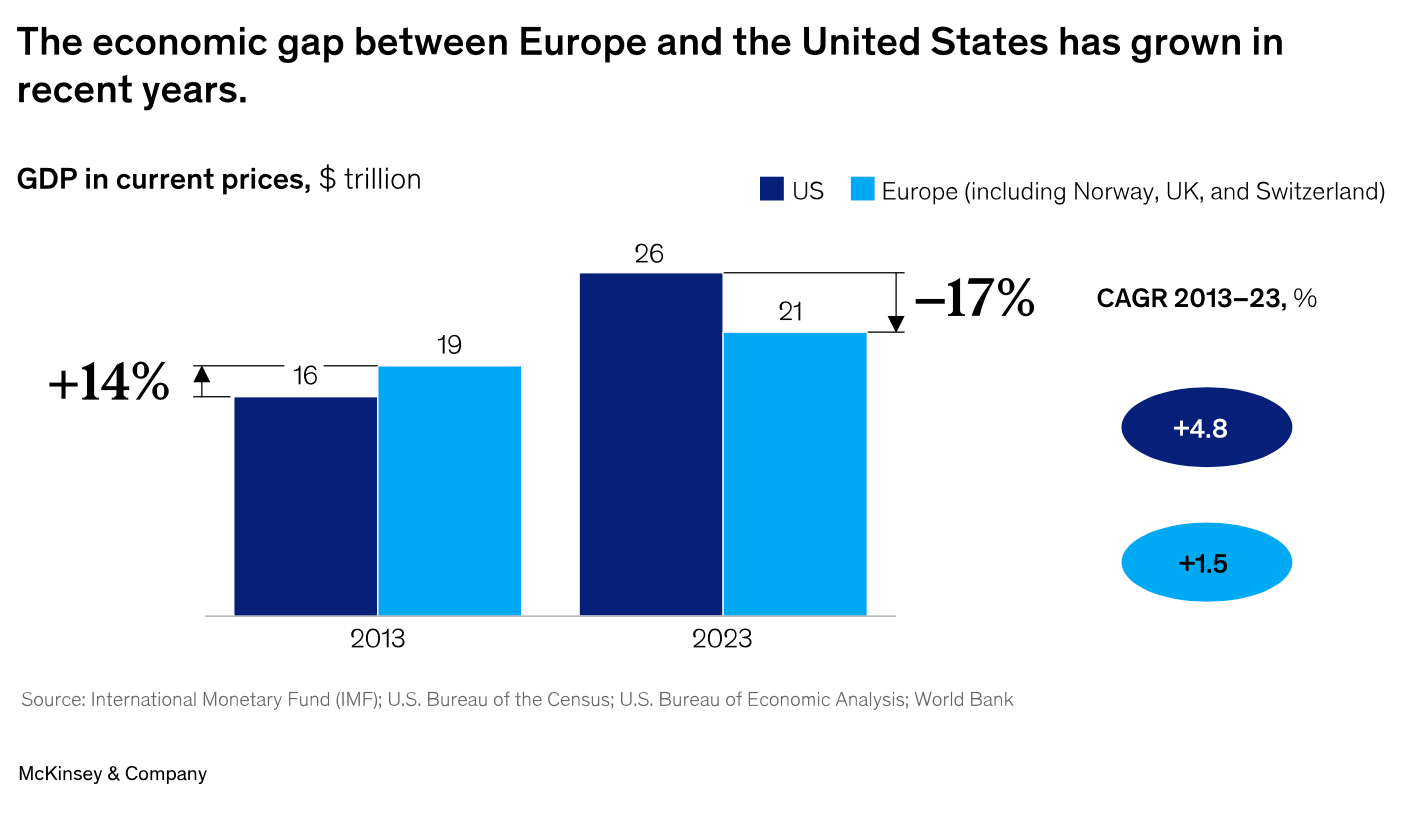

In the last 15 years the economic gap between the European and US economies has widened, mainly due to the startling differences in their tech sector.

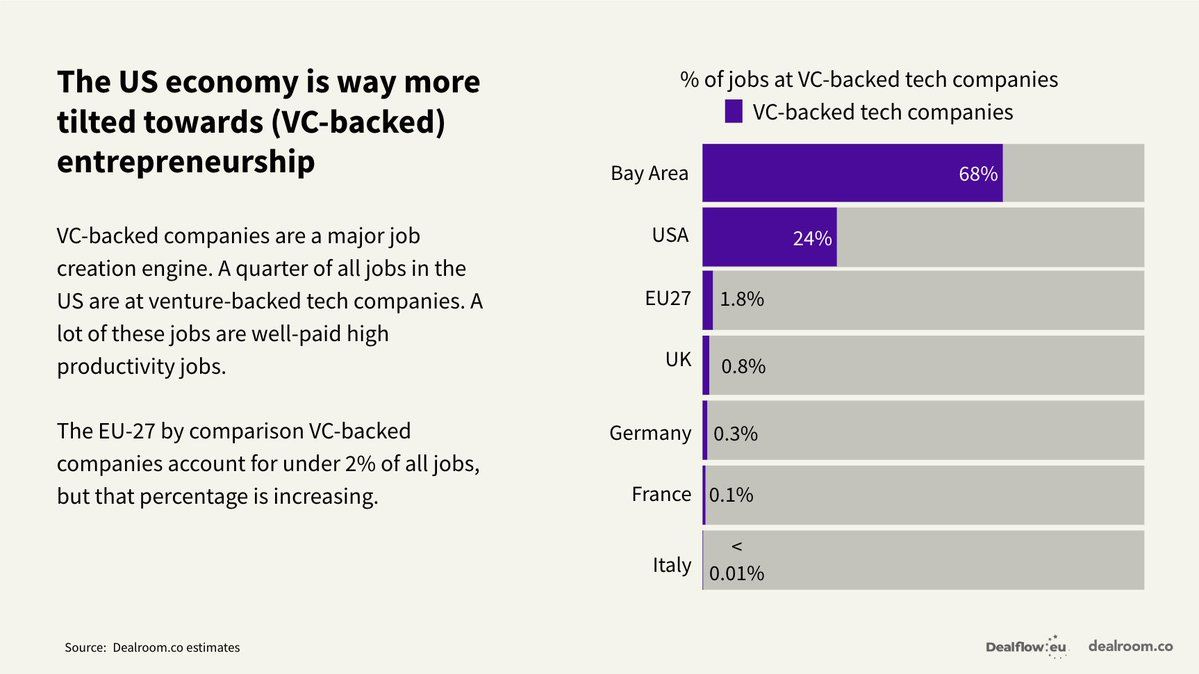

As of today, an impressive 25% of jobs in the USA are provided by Venture Backed firms. This means that 1 out of 4 workers are working to build the future 😮. The percentage in the EU? A mere 1.8%…

But it does not need to be this way. Not long ago European companies were leading large parts of the hardware (Nokia), automotive (Volkswagen Group) and software markets (Skype, SAP).

So what are the problems that led to this decline and how can we revive the European economy and technology sector?

Here you can find a cheat sheet with 5 challenges and 5 reforms to bring the European economic empire back on track 🚀🇪🇺

A. Challenges Facing the European Tech Sector

Regulatory Barriers and Market Fragmentation 💔: Europe’s multi-country makeup can hinder tech scale-ups. Companies must navigate different languages, regulations, and business cultures across the 27 EU states (plus the UK, etc.), unlike the large unified domestic markets of the U.S. or China. Moreover, European regulators tend to take a stricter stance (on issues like antitrust, privacy, AI usage), which, while protecting consumers, can limit the agility of tech firms. The net effect is a slower scaling process – one analysis found European startups take nearly 10 years longer on average than U.S. startups to grow into large companies.

Funding Gaps at Scale 💸: Early-stage capital in Europe (seed and Series A) is relatively plentiful now, but growth-stage funding remains a weak spot. European startups often struggle to raise the mega-rounds needed to compete globally, leading them to look abroad for investors. U.S. venture funds manage roughly 20× more capital than EU funds ($1.3 trillion vs €72 billion), which means American startups can generally tap much larger pools of money for scaling. As a result, many European companies feel pressure to relocate or incorporate in the U.S. to access capital. Over the past decade, Europe has underfunded its later-stage companies by an estimated $300B+ relative to the U.S.. The reliance on foreign capital also creates a risk of economic leakage – if a U.S. investor leads a large round, they might eventually encourage the company to move its headquarters or go public in New York, taking talent and economic activity with it.

Brain Drain and Talent Retention 🧠: Europe produces abundant tech talent through its universities and engineering schools, but retaining that talent is an issue. Between 2016 and 2021, the talent flow was positive (more tech workers coming into Europe than leaving), but that trend reversed after 2021. By 2024, roughly 20% of the European tech workforce consisted of international talent, but more people are now leaving for places like the U.S. and Canada than arriving. This “brain drain” is fueled by factors such as higher compensation packages in the U.S., deeper technical teams at big tech firms abroad, and sometimes a perception of better career prospects in more mature ecosystems.

Competition with U.S. and China’s Tech Dominance 🇪🇺🇺🇸🇨🇳: The global tech race is led by American and Chinese companies, and Europe is playing catch-up. As of late 2024, none of the world’s highest-valued tech firms are European – the trillion-dollar market cap club is entirely U.S. (Apple, Microsoft, Google, Amazon, etc.) or Asian (Taiwan’s TSMC). In fact, only two European tech companies (ASML and SAP) rank among the world’s top 25 by market capitalization. This highlights a gap in scale and global influence. European consumers heavily use U.S. platforms (Facebook, Google, Netflix) and Chinese hardware (phones, etc.), which not only tilts market share to those firms but also means Europe’s tech sector doesn’t capture as much local spending.

Fear of failure, risk aversion and scaling Challenges 😨: Europe has tended to be more risk-averse – entrepreneurship was not always the first career choice for top graduates (though this is changing with success stories). Failure carries more stigma in some European cultures, which historically discouraged taking big risks on bold ventures. This contrasts with Silicon Valley’s fail-fast mentality that tolerates and even valorizes failure as a learning step. Timidity and conservatism in investment extends to consumers and enterprises as well – for example, European businesses have been slower to cloud adoption than U.S. peers, affecting local cloud startups’ growth. Bridging this gap will require not just capital, but also cultural shifts and supportive policy (as discussed next).

B. Reviving the Startup Scene: Strategies and Policy Recommendations

To overcome these challenges and fully unlock Europe’s tech potential, a multi-pronged approach is needed, including:

Funding and Scale-Up Capital Increase 🤑💰:

European regulators should enable institutional investors (pension funds, insurance) to invest more in venture capital. For example, U.S. pension funds were freed in the 1970s to invest in VC, unleashing a flood of capital that helped create Silicon Valley. Europe can follow suit – EU pension funds hold €4 trillion+ in assets, yet invest only a tiny fraction in tech startups. Even a twenty-fold increase in pension VC allocations (which would still be <0.2% of their assets) could triple the annual VC funding in Europe.

Additionally, completing the Capital Markets Union would make it easier for startups to raise money across European exchanges and investors to participate across borders.

The creation of pan- European late-stage funds (such as the European Tech Champions Initiative) or public- private “scale-up” funds can provide the big checks that local VCs cannot.

Policy Support and Regulatory Streamlining ✂️🚀:

Governments can simplify legal frameworks for startups – e.g. easier company registration, unified rules for digital services – and

The EU should pursue truly integrated single markets in areas like fintech, healthtech, and telecom. The goal should be that a startup can offer a digital product across the EU with minimal country-by- country tweaks.

Agile policymaking is also key: regulators might adopt more “sandboxes” where new tech (drones, fintech, AI tools) can be tested under relaxed rules. Ensuring that major EU regulations (like the AI Act) are implemented in a balanced way will be crucial so that they protect rights without inadvertently stifling innovation.

Public procurement is another lever – European governments and the EU could allocate a portion of procurement to startups and scale-ups (for defense, healthcare, smart city projects, etc.), giving young companies valuable reference customers and revenue.

Talent Development and Retention 🦸🏻♂️💪:

On the education front, encouraging STEM fields and entrepreneurship training (through university incubators, coding bootcamps, etc.) will grow the talent pipeline.

To retain and attract global talent — in a time when the US is taking the opposite direction, Europe can expand startup visa programs and make work visas for skilled tech workers more accessible across the EU.

Simplifying employee stock option policies is also vital – startups should be able to offer competitive equity to employees without onerous tax burdens (some countries have improved this, but a unified EU approach would help).

Culturally, Europe needs to continue embracing entrepreneurship as a desirable career: successful founders and tech leaders can be promoted as role models to inspire the next generation. Building networks of mentorship (e.g. experienced founders mentoring new ones) and celebrating successful risk-takers helps cultivate an entrepreneurial mindset.

Moreover, bridging the gap between research and commercialization can turn Europe’s academic strength into talent and startups – universities and institutes should be incentivized to spin out companies (through technology transfer offices, seed funds, etc.), and researchers given support to become entrepreneurs. Programs to place PhDs into startups or encourage industry-academia exchange can spark more deep-tech ventures.

Promoting a Risk-Taking Culture 🏆🎲:

To truly boost innovation, Europe will benefit from a mindset that is more tolerant of risk and failure.

Policymakers could examine insolvency and bankruptcy laws – enabling honest failed entrepreneurs to restart quickly (the U.S.’s Chapter 11 system often gives second chances, whereas some European legal systems are more punitive).

Likewise, expanding social safety nets for entrepreneurs (such as portability of benefits, or even income support for a period after a startup failure) might reduce the personal risk of founding a company.

On the societal level, continuing to highlight success stories and downplaying the stigma of failure will encourage more individuals to take the leap. Ultimately, Europe needs to solidify a “why not us?” attitude – the confidence that European teams can build global tech leaders – which is gradually forming as more homegrown companies succeed.

Focus on Strategic Sectors ♟️🎯:

Artificial Intelligence is a clear focus – the EU and national governments are investing in AI research centers and compute infrastructure (e.g. the EuroHPC initiative for supercomputers) to support AI startups. Europe’s emphasis on ethical AI and data privacy can be turned into a brand advantage, creating AI products that users and other governments trust. For instance, European AI firms compliant with the upcoming AI Act could have an edge in safety-critical domains like healthcare or automotive.

Deep tech (spanning advanced materials, robotics, quantum, space) is another forte of Europe’s well-funded science base. By providing patient capital and expertise to deep-tech startups, Europe can lead in breakthrough innovations – as seen with companies like CEA-Leti’s spin-offs in nanotech or Germany’s Isar Aerospace in NewSpace.

Green technology is also a strong opportunity: with aggressive climate targets and public support, European startups in renewable energy, energy storage, electric mobility, and circular economy solutions enjoy a large home market and a chance to export their solutions globally.

Thank you for reading the Europragmatist.

Stay tuned for more proposals to change Europe 💛💙.